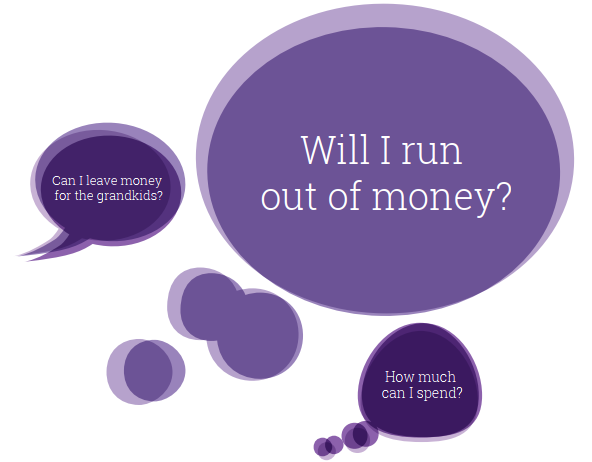

For pension & investment clients, our advice involves more than just ‘making money’. Cashflow planning will be central to our discussions. This could involve simple projections to retirement age to more complex planning involving simulated market declines and establishing sustainable withdrawal rates. Check out our video for further information.

Most frequent questions and answers

Yes – 100%. This means we are not linked to any insurance or investment providers, allowing us to select the most appropriate solution for you. We are also directly authorised with the Financial Conduct Authority.

No – There are lots of factors to take into account when planning for retirement. There are great tax benefits to saving into a pension and with the new flexibilities afforded by the Pension Freedoms legislation, the way you access your pension has never been easier.

You might not need anything extra. It all depends on your circumstances and your views on insurance.

Remember though, your employer offers life insurance/Critical Illness cover/Income Protection etc as an employee benefit and they are not obliged to offer these. What if they decide to remove them. What if you move onto another employer – does the new employer offer the same benefits. By arranging your own protection policies, they are guaranteed to remain in place if you pay the monthly premiums.

Too many reasons to list here!

One of the disadvantages and great advantage of pensions…you cannot access your money until age 55 (for now).

Add in the tax advantages and better historical returns, pensions should definitely form part of your overall plan. Cash at the bank has it’s place, but not for long-term retirement planning.

Just yourself and anyone else you want involved (spouse/children). We’ll have a chat about your circumstances and go from there.

Your first meeting is at our cost, just to establish how & if we can help.

“If you can’t explain it simply you don’t understand it well enough” – Oliver McDonald. Apparently Einstein may have said something similar.

We’ll always keep our advice at a high level and explain in plain English.