In the run-up to Halloween, you might spend your time decorating your home, picking a costume, or lining up horror films to watch with your friends and family.

While ghosts and ghouls might give you a fright, there are some financial errors that can be far scarier – and much more costly – than any Halloween shock.

With this in mind, continue reading to discover five spooky financial mistakes you may wish to steer clear of this Halloween to protect your wealth.

1. Holding too much of your cash in a low-interest savings account

Perhaps one of the eeriest financial mistakes you can make is holding too much of your wealth in a low-, or even zero-interest, savings account.

Despite interest rates on easy access savings accounts standing at around 5%, according to Moneyfacts, research from AJ Bell shows that there is £253 billion still sitting in UK savings accounts paying zero interest.

While leaving your money in these accounts might seem like less hassle than shopping around, inflation could quickly erode the purchasing power of your wealth over time. This might lead to some scary outcomes – not least, having fewer opportunities to pursue your goals due to a lack of financial stability.

Rather than letting your cash stagnate in these low-interest accounts, it might be wise to put it to better use, either in investments that align with your risk tolerance and long-term goals, or a savings account that offers a competitive rate of interest.

2. Not adequately protecting your wealth

Some of the most chilling Halloween horror films centre around unsuspecting victims of devilish attacks that threaten their lives.

It’s easy to believe that a serious injury or illness is unlikely to happen to you, but this kind of thinking could come back to haunt your financial wellbeing if the unexpected strikes.

In fact, Cancer Research UK reveals that there were more than 385,000 new diagnosed cancer cases in the UK between 2017 and 2019.

What’s more, a survey from Macmillan Cancer Support shows that 83% of people diagnosed with cancer notice a financial impact, facing average costs of £891 a month on top of their usual outgoings. Suffering from a severe illness without adequate protection in place could affect you and your loved ones’ financial security.

There are several invaluable forms of protection that could safeguard your wealth and wellbeing from the unexpected, such as:

- Income protection – Provides you with a regular source of income if you’re unable to work due to an accident or illness.

- Critical illness cover – Pays a tax-free lump sum if you’re diagnosed with a serious health condition.

Not only may protection help to cover costs if you face a loss of income, but it can also mean you can focus entirely on your recovery rather than financial worries.

If you’re a business owner, then executive income protection is worth considering as it offers more coverage options and can be more efficient from a tax point of view.

3. Pausing pension contributions

Whether you’re struggling with higher living costs or simply wish to free up some extra cash each month, you might be tempted to pause or reduce your pension contributions.

However, doing so could lead to a chilling outcome when you eventually reach retirement, as the long-term effect on your savings can be significant, potentially affecting your ability to live comfortably later in life.

For instance, research from Royal London shows that if you earn £70,000 a year and make 8% pension contributions, matched by your employer, you could gain an additional £3,360 a year in take-home pay if you stopped contributing.

Though this sounds like a “treat”, it could actually turn out to be a “trick”. Stopping these contributions for one year would result in a loss of £12,192 from your pension pot (assuming a 5% annual return) – a considerable shortfall.

Maintaining your pension contributions is particularly important considering that life expectancies are rising in the UK. FTAdviser reveals that the number of centenarians in the UK could reach 29,000 by 2041, a 78% increase from 16,000 in 2021. This means you could spend 20, 30, or even 40 years in retirement.

If you pause your pension contributions, even for a short time, you may end up with a shortfall in the later years of retirement and could struggle to afford later-life care, which one of our previous articles covers in great detail.

As such, you might want to find extra funds from other sources, such as your savings accounts, before you consider pausing pension contributions to free up some extra money. This way, you might avoid being spooked by financial precarity later in life.

4. Panic-selling investments during periods of volatility

Market volatility can sometimes feel like something out of a horror film. You might be tempted to sell your investments out of fear when their value drops, in an attempt to cut your losses.

This said, selling when share prices dip could significantly affect the long-term performance of your portfolio.

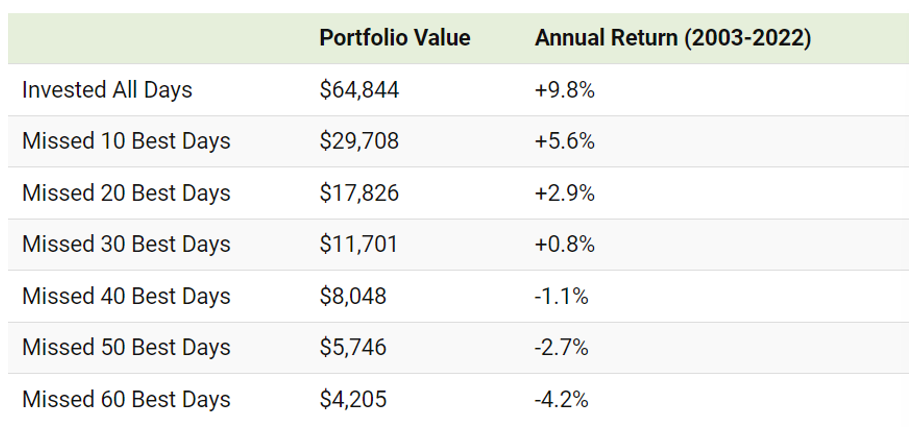

The table below from Visual Capitalist reveals the total returns of a $10,000 investment in the S&P 500 between 1 January 2003 and 30 December 2022.

Source: Visual Capitalist

As you can see, if you had remained invested over this entire period, your original investment would have grown to more than six times its value.

However, if you missed the market’s 10 best-performing days because you sold shares during unsteady times, your investment would only have grown to just below $30,000. Miss 60 of these days, and it would have seen a negative return, resulting in a value of $4,205.

While a character in a horror film might make split-second decisions in an attempt to save their own life, you don’t need to do this where your investments are concerned. By giving in to knee-jerk reactions, you might crystalise your losses and miss out on future gains.

Instead, it’s worth focusing on your long-term financial goals, and remembering that markets tend to recover over time.

5. Underestimating the importance of your emergency fund

No matter how much you plan ahead, there might be unexpected expenses looming right around the corner that could result in an eerie jump scare. That’s where your emergency fund comes in.

Whether it’s a sudden car repair, a period of illness, or even a broken boiler, without an emergency fund you might be forced to sell shares or take on high-interest debt to cover these costs, both of which can derail your progress towards your long-term goals.

And, as the cost of living continues to rise, MoneyAge reveals that the cost of three months’ worth of essential expenses has increased by £1,028 over the past two years.

This makes having a healthy emergency fund more crucial than ever, as it can act as a financial safety net that protects your wealth and wellbeing.

It’s worth saving between three and six months’ worth of essential household expenses in an easy access savings account. If you’re self-employed or have dependents, you may want to consider putting aside more, potentially as much as a year of expenses if you can.

Having this in place can give you the peace of mind that you’re able to handle any scary unforeseen costs without having to put your financial security at risk.

Get in touch

We can help ensure that a financial mistake isn’t on your list of scares this Halloween.

To find out more, email us at [email protected], or call 01273 076 587.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.