Have you fancied a cinema trip recently, only to discover that almost all the films listed are sequels or revivals? It seems that in today’s world, when a film turns out to be successful, we can almost certainly expect at least one sequel to emerge.

Some critics call this trend “lazy”, while others see it as good business sense. If an idea proves lucrative, it can make sense to squeeze as much value out of it as possible.

Whatever your opinion of sequels, there are undeniable lessons to be learned about making the most of what you’ve got.

So, read on to find out what the age of the sequel can teach you about managing your long-term financial plan.

Just like a killer movie franchise, your investment portfolio can be the gift that keeps on giving

Investing your wealth is a long-term move that involves trusting the process. With inflation still in double figures as of March 2023, the Office for National Statistics (ONS) reports, investing your wealth could be an essential tool for you to combat its effects over the years. Yet some people find it hard to stay the course and can be tempted to cash in on short-term returns.

If you can relate to this feeling, it might help to know that many of your favourite movie franchises didn’t see their biggest success on their first try. While the initial “investment” usually sees good profits at the box office, often it’s the sequels that bring in the big bucks.

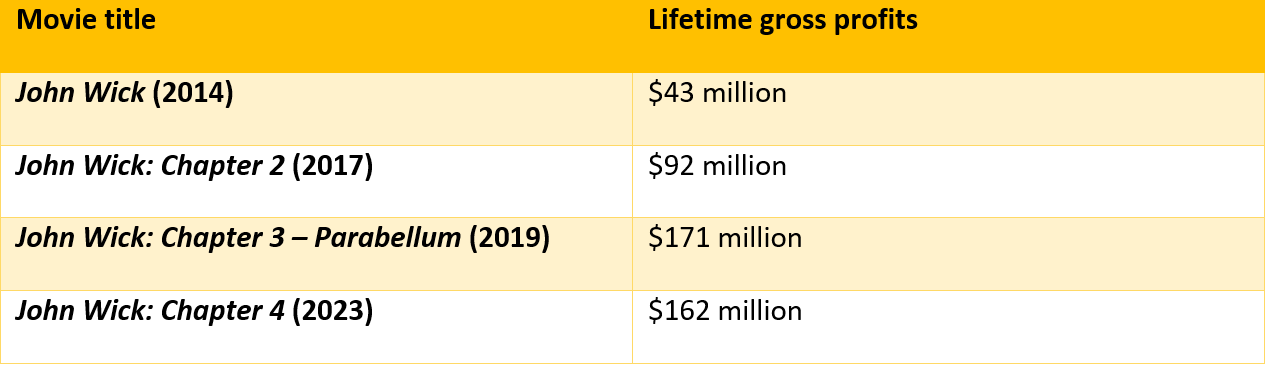

The below table shows the lifetime gross profits of the John Wick action series as of 20 April 2023.

Source: Box Office Mojo

There are two key takeaways from the above:

- Although the initial investment, John Wick, was a success, filmmakers knew that by continuing to grow their “portfolio” of films, they could reap even more from what they had.

- As the investment has gained traction, it has become increasingly profitable, with Chapter 4’s gross profits almost matching its predecessor, despite only having been released this year.

So, if you are tempted to cash out your investments as soon as they yield some returns, take a leaf out of Lionsgate’s book and remember: good things often come to those who wait.

If retirement is the sequel, your career is the original movie that makes it all happen

Great sequels aren’t just made off the cuff, they’re planned years ahead of time.

Although a sequel can be even more lucrative than the original film, without the studio’s accurate forward planning, it’s unlikely the next film will be a success.

Take Avatar as an example. The original 2009 film broke box office records – in fact, according to Statista, it is still the highest-grossing movie of all time.

13 years later, Avatar: The Way of Water burst into the cinematic universe, almost instantly becoming the fourth-highest grossing film of all time, Disney reports. Now, Cameron has the means to make five Avatar films, instead of the planned three.

You might be thinking: “what does Avatar have to do with my retirement?”

Often, our clients see retirement as the “end goal” when they’re working up to it. But retirement is actually the beginning of a totally new phase in your life – one that could last many years – and like any good sequel, it needs a solid foundation to make it a success.

So, if you’re approaching your desired retirement age, it’s important to put in the groundwork now. This could include:

- Maintaining or increasing pension contributions within the Annual Allowance, which stands at £60,000 a year as of 2023/24

- Considering how your tax situation could change when you stop work, begin taking your pension, and perhaps receive an inheritance in the coming years

- Thinking about what could happen if you were to pass away or become ill, and ensuring you have the appropriate protection in place

- Planning an amazing bucket list holiday, helping the next generation onto the property ladder, or a similarly exciting endeavour that will require spending a significant sum.

Starting these preparations years before you actually retire can ensure you are fully primed to make the “sequel” of your life a roaring success – and even have enough to enable the next generation to continue your “franchise” in the years to come.

Once you find a working relationship that thrives, stick to it for life

We all have our favourite classic characters who just seem to work on screen. From James Bond and Moneypenny to Sam and Frodo, there’s something about the chemistry, the yin and yang, that makes them watchable time and again.

Filmmakers know this well: find an iconic duo, and you’re set for a movie franchise that will have audiences flocking to cinemas every single time.

In your own life, you will have people you couldn’t live without – but when it comes to forming an alliance that boosts your finances, your financial planner could be just that.

We can:

- Use cashflow modelling software to help you determine exactly when and how you can retire

- Advise on building a robust investment portfolio

- Listen to your visions for the future and push you in the right direction

- Meet your whole family and create a financial plan that works for everyone.

Get in touch

If you’re still looking to find the Doc Brown to your Marty McFly, get ready for the trip of a lifetime! Email us at [email protected], or call 01273 076 587.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Financial Conduct Authority do not regulate cashflow planning.