As the US presidential election on 5 November 2024 draws near, the race between former President Donald Trump and Vice President Kamala Harris is certainly intensifying.

Since Joe Biden stepped down due to concerns regarding his mental capacity, Harris has taken up the mantle for the Democrats, making the contest fiercely competitive.

Indeed, polling averages reported by the Independent show that Harris was pulling very slightly ahead of Trump at the time of writing (23 October 2024). With the race so close, it’s hard to predict what will actually happen on election night.

Given that political shifts in the US often influence worldwide economies and the global stock market, you may be curious about how the outcome of the election could affect your investments. While elections often bring volatility to markets, it’s important to remember that making imprudent decisions could hamper the long-term performance of your portfolio.

Continue reading to discover how the election could affect financial markets, and why keeping a level head is essential regardless of who wins.

Markets might initially react hesitantly to a Harris presidency, but this may be short-lived

If Harris wins the election, her presidency could largely continue the policies of the Biden administration, particularly in areas such as environmental sustainability and wealth distribution.

She has made it clear that her focus will be on building a stronger middle class and protecting workers’ rights, which could mean increased spending on healthcare, education, and affordable housing.

To fund these initiatives, Harris may raise taxes on corporations and wealthy individuals.

This could initially result in hesitancy from investors, affecting the market. Analysis from IG suggests that higher corporate taxes and tighter regulation might cause some investors to pull back temporarily.

However, this volatility may be short-lived. Markets tend to adjust once the election outcome is known, and over the long term, investors might actually welcome the stability of a Harris presidency.

If Trump wins, the US may face tax cuts and deregulation

In complete contrast, a Trump win could result in a return to some of the economic policies seen during his previous term. Trump is expected to push to make his 2018 tax cuts more permanent, which would particularly benefit higher earners and corporations.

Moreover, he has consistently advocated for deregulation over the years, especially in sectors such as financial services and energy. This could boost companies’ profits in the short term, potentially creating optimism in some sectors.

Though, a Trump presidency would also come with an element of uncertainty. The Independent reveals that, during his four years in office, Trump made more than 30,000 false or misleading statements – equating to roughly 21 a day – which often led to confusion and market uncertainty.

This unpredictability, paired with potentially higher tariffs placed on certain countries, may result in more volatility than usual.

The US economy has remained resilient through the country’s previous political shifts

Despite the inevitable uncertainty surrounding the election on 5 November, it’s vital to note that the US economy has remained incredibly resilient over time, regardless of the governing party.

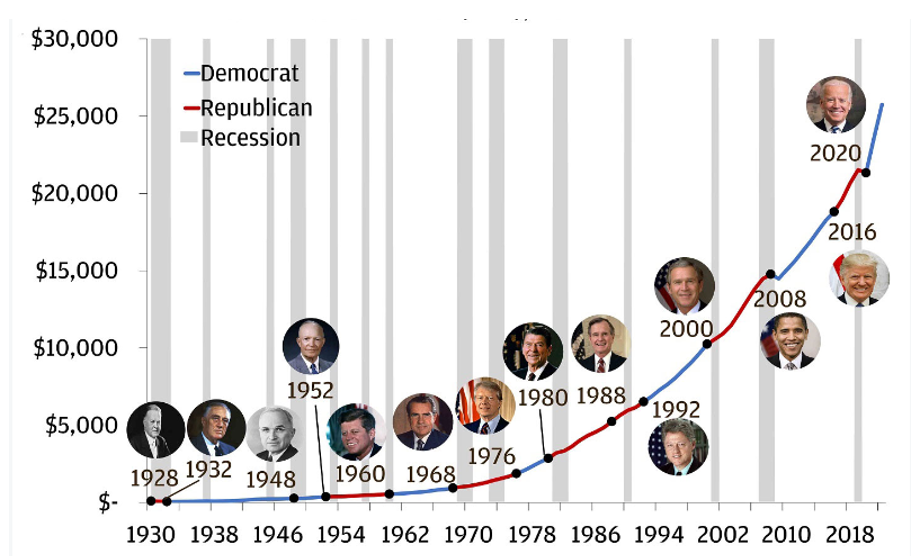

The graph below shows nominal US GDP growth in billions of dollars between 1930 and 2018, with data running until the third quarter of 2023.

Source: JP Morgan

As you can see, the country’s GDP has continued to rise steadily over the years, highlighting the fact that no matter who wins, the economy could potentially remain as resilient as ever.

While GDP doesn’t necessarily directly correlate with market performance, sustained growth does generally support long-term market stability and potential returns.

What’s more, data from CNN shows that a portfolio of 60% shares and 40% bonds still delivered positive returns in all but four of the past 24 presidential election years since 1928.

This should serve as a reminder that while the election may result in short-term volatility, staying the course could be the wisest approach, as markets tend to recover in the long run.

Above all, keeping a cool head could help you manage the emotional side of the election

Letting your emotions rule your investment decisions is often unwise, but thankfully, there are some ways you can avoid doing so.

Stay away from the “noise” and recognise cognitive biases

It’s important to note that in the run-up to elections, politicians tend to make bold claims, painting negative pictures of what might happen if the other side wins.

The media often latches onto these claims, creating a constant stream of speculation and sensationalist headlines.

It’s easy to feel deafened by this “noise”, but it’s worth remembering that making investment decisions based on such rhetoric could hamper the overall performance of your portfolio.

Indeed, it could lead to several emotional biases, which prompt an emotional response regarding your investments. One such bias is “loss aversion”.

This is when you experience the fear of loss twice as strongly as the pleasure of gains, which might tempt you to sell investments during periods of uncertainty, even when logic tells you that markets will likely recover over time.

Similarly, herd mentality – which is the desire to follow the crowd – could lead you to make decisions based on the actions of others rather than what aligns with your long-term goals.

If you find yourself becoming anxious or overwhelmed by election news, it might be worth limiting your exposure to media coverage.

While staying informed is important, overloading yourself with information could only serve to heighten any anxiety, potentially leading to cognitive biases or impulsive decisions that affect your financial wellbeing.

Ensure your portfolio is adequately diversified

Another proactive step you could take ahead of the election is to ensure that your portfolio is well-diversified.

Spreading your investments across various sectors, asset classes, and geographical areas could help mitigate risk. If one area of your portfolio is affected by short-term election-related volatility, gains in other areas may offset losses.

This could help you remain calm during periods of uncertainty, safe in the knowledge that you’ve already taken steps to protect your investments from market swings.

Additionally, diversification allows you to focus on your long-term goals rather than reacting to short-term fluctuations.

Get in touch

If you’re still concerned about how the upcoming US election might affect your wealth, we can help you secure some much-needed peace of mind.

Email us at [email protected], or call 01273 076 587 to find out more.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.